Estate planning can be complicated enough without having to contend with similarly-named documents like LivingsWills and your Last Will and Testament. It’s easy to forget or simply disregard one or the other document because you think you have it covered. As estate planning lawyers, we understand the confusion and hope to alleviate some of the confusion here.

Living Wills

People refer to living wills in a variety of ways, increasing the degree of difficulty in managing your estate planning and healthcare planning endeavors. Living wills have been referred to as healthcare powers of attorney, advance directives and a medical directive. At its’ essence, a living will is a legal document that you provide to your primary care or other physicians that outlines how you want to be treated in the event that you are incapacitated and unable to make medical decisions for yourself. In Wisconsin, a living will may address topics such as:

- whether you want to withhold or withdraw life-sustaining medications under particular circumstances;

- whether you would refuse life-saving healthcare treatments

- whether you would refuse life-sustaining feeding

For example, if you have a terminal condition, as confirmed by two doctors, or are in a persistent vegetative state, as confirmed by two doctors, you might want to withhold certain treatments and life-sustaining measures in the event that another medical emergency occurs.

This document must be signed in the presence of two witnesses and should be provided to your doctors and closest family members. This last step is not required, but may be helpful if no one else knows about your living will. If you have living relatives, it is advised that you talk with them about your living will and let them know where you keep a copy of your latest living will.

While you are completing your living will, it is also advisable to complete a healthcare power of attorney, naming a trusted person as your representative in healthcare matters when you are incapacitated. A similar document, the financial power of attorney, may also be completed, naming someone you trust as your personal representative for financial matters. This does not have to be the same person, as the skills and characteristics required for each are vastly different.

Finally, you should consider completing a disposition of remains form that specifies in detail how you want your remains to be treated. Often, people place this information in their will. This is a bad idea, since most wills are not opened until after the time for making this decision.

Last Will and Testament

Your last will and testament is an entirely different legal document that addresses how you would like your assets to be distributed upon your death. It can be used to distribute assets that are not otherwise governed by operation of law, which means property held in joint tenancy and life insurance proceeds may not be distributed through your will. Every person over the age of 18 should have a will in place. This document should be reviewed on an annual basis and at anytime you experience a significant life event. Your will may be revoked and replaced at any time.

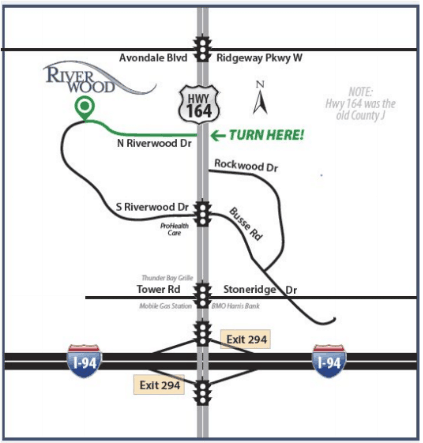

If you have questions about living wills, wills, trusts and other estate-planning mechanisms, the best thing you can do for your family and your own peace of mind is to strategize with an experienced Wisconsin estate-planning attorney. Contact the attorneys at Riverwood Legal & Accounting Services, S.C. today for a consultation.