People who are exploring their options in estate planning strategies usually want to reduce the amount of their estate taxes, protect assets and reduce income taxes. While many financial vehicles can accomplish some or all of these goals, some people opt to set up a Family Limited Partnership (FLP), particularly if the family owns any business interests. If you are thinking about your estate planning, you might benefit from a discussion with an experienced estate-planning lawyer.

Using Family Limited Partnerships for Business Succession

Family limited partnerships can come in various forms, depending on the family’s situation. If for example, the parents want to bring their adult children into the family business but do not want merely to hand them the keys and walk out, an FLP can be useful. FLPs allow parents to start the process of transferring assets over to their children while retaining control over the property while the children learn the ropes of the family business. The parents are the general partners, and the children are the limited partners.

Liability of General and Limited Partners in an FLP

Only family members can be partners in a Family Limited Partnership. As long as the parents are the general partners, they have the right to run the business and make the day-to-day decisions. As limited partners, the children cannot vote or control the business. The general partners are liable if the business fails. If the children invested in the enterprise, they can lose money if the business fails, but only up to the amount of their investment.

Protecting Assets with a Family Limited Partnership

After creating the FLP, the general partners transfer family assets to the limited partnership. Legally, the partners no longer own these assets. A personal creditor of a partner cannot take the property since it belongs to the limited partnership, not the individual.

Using an FLP to Reduce Taxes

Families can use an FLP to spread out the family income, thereby reducing the total income tax burden of the family. A partnership does not pay taxes. It files an informational tax return every year, but partnership income or losses flow through to the partners. The partnership agreement governs the distribution of income and losses. The partnership can pay some of the parents’ income to the children, or reserve some of it in savings for the children. If the parents are in a higher tax bracket than the children, some of the family income will have a lower tax rate.

The most impressive tax savings of FLPs, however, are in the area of estate taxes. The strategy goes like this:

- Parents gift “shares” or interests in the FLP every year to their children, up to the amount of the maximum gift tax exclusion for that year.

- The shares represent a much higher asset value than the cash amount of the gift tax exclusion because the parents are allowed to discount the value of the shares, since the children are only limited partners, with no right to vote or run the business.

Every year, the total value of the parents’ estate goes down more, which also reduces the estate tax liability. By leveraging asset value through gifting interests in a Family Limited Partnership, some parents have brought their estates below the estate tax limits and eliminated estate taxes.

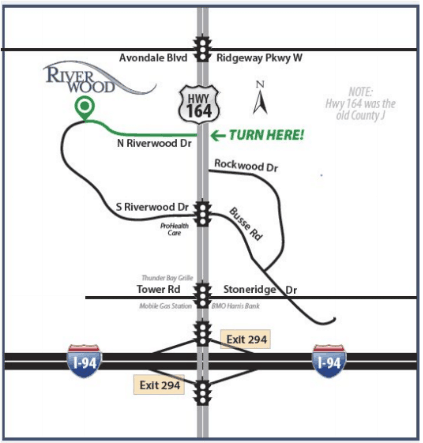

The laws that affect family limited partnerships can change at any time. If you have questions about probate or estate planning we’d be happy to help, contact the attorneys at Riverwood Legal & Accounting Services, S.C. today for a consultation.