Most attorneys will tell you to do almost anything you can to avoid probate. That’s because probate tends to be long, complicated, and expensive. But sometimes you don’t have a choice, so it’s important to know what is involved in the probate process. Of course it is always a good idea to talk with an experienced probate or estate administration lawyer.

Why is probate so expensive?

Probate is the process of using the court to supervise the distribution of a person’s property (or “estate”) after they die. That can include validating the person’s will and then dividing the property as he or she asked, or if they didn’t leave a will it involves distributing the property according to a plan established by the State of Wisconsin.

Part of this distribution itself is expensive. For example, during probate any creditors who are owed money can come forward to collect on the debt. Additionally, some property that goes through probate is subject to the federal estate tax, or “death tax.”

The process of probate is expensive as well. Court costs are typically paid by the estate’s assets, as well as the cost of a probate bond—essentially insurance that the person handling the estate will do so appropriately. And because most parties in court are represented by lawyers, there are attorneys’ fees as well.

How does probate work?

When the probate process begins, the court will appoint someone to be the “personal representative” of the estate (sometimes called an “executor” in other states). This is the person who will be responsible for transferring the estate’s property to the heirs and creditors. In many cases the process can be informal, and may take place mostly through the mail. However, in cases where there are disputes about the person’s estate, those issues will have to be decided formally by a probate judge.

How long does probate take?

Even for small estates and simple cases, you should expect probate will take at least six months. For large estates or cases with a lot of disputed issues, the process can take two years or more. The process begins with the personal representative notifying the person’s creditors that he or she has died. Providing legal notice can take several weeks, and after creditors are notified of the death they have three months to file claims with the estate’s personal representative.

Additionally, the personal representative will be required to pay the estate’s taxes, including income taxes and any estate tax. When an estate is large enough to owe an estate tax, the personal representative has up to nine months to make arrangements to have it paid. Some counties in Wisconsin are pushing to have probate cases completed within one year, although Wisconsin law allows for a year and a half. Additionally, the court can grant extensions to the timeline for a variety of reasons.

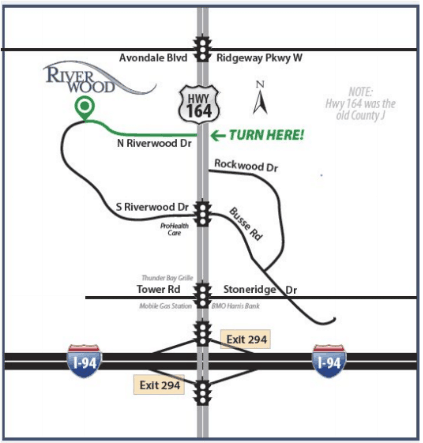

Probate and estate planning are complicated areas of law that take years and years of experience to achieve true expertise. At our firm, our attorneys have decades of experience handling hundreds of estates, both in and out of probate. If you have questions about probate or estate planning we’d be happy to help, contact the attorneys at Riverwood Legal & Accounting Services, S.C. today for a consultation.