Many people assume that trusts are for wealthy individuals and families. However, utilizing trusts can benefit anyone who is developing an estate plan. Trusts provide specific advantages that you cannot achieve through other estate planning strategies. The key is to work with an experienced Wisconsin estate-planning lawyer. Your attorney can explain the different types of trusts, pros and cons of using trusts, and how a trust can accomplish your goals efficiently and effectively.

Benefits of Using a Trust as Part of Your Estate Plan

Trusts are a useful tool in estate planning. Unlike a will, trusts can also be used during your lifetime to accomplish your goals, which make them even more valuable as a financial tool for individuals and families.

From living trusts and testamentary trusts to special needs trusts and tax by-pass trusts, there are many different types of trusts to choose from for your estate planning needs. Each trust accomplishes certain goals; therefore, your estate attorney will need to discuss your needs and goals to determine the trust that is best for you.

However, below are six benefits that most trusts provide:

- Elevated Level of Control — A trust offers more control over assets and beneficiaries compared to a standard will. You can define how assets are managed, before and after your death. You also have more flexibility in deciding how income from the trust is paid to beneficiaries and assets are distributed.

- Protection of Assets — Placing assets in a trust can protect the assets and income from those assets from creditors, collection actions, and lawsuits. The trust can protect heirs from losing assets because of lawsuits or collection actions against the heirs too.

- Avoid Probate — Some trusts allow you to avoid the probate process altogether. The assets in the trust pass outside of the probate estate. Therefore, the assets are not subject to the debts of the estate. Avoiding probate can save money and time for your heirs, in addition to avoiding the stress of dealing with the probate court. In addition, a trust may decrease family arguments and probate litigation.

- Protect Benefits for Heirs — If an heir receives government benefits, such as Medicaid or SSI, receiving an inheritance could jeopardize the person’s benefits. However, a trust can provide for the person without impacting his or her eligibility for benefits. In some cases, a special needs trust may be the best choice to provide for the needs of your loved one without cutting off the government benefits they need.

- Decrease Estate Taxes — While Wisconsin does not have estate taxes, your estate could be subject to federal estate taxes depending on the size of your estate. Large estates can benefit from the use of trusts to decrease the amount of money heirs must pay in federal estate taxes.

- Increased Privacy — Probate estates are a matter of public record. However, trusts are not subject to public disclosure. You can keep your financial affairs private so that you do not need to worry about anyone, including heirs that might not benefit from the trust, from knowing the terms, conditions, and assets within the trust.

In addition to the above benefits, you may discover that using trusts can provide additional advantages depending on your situation.

Call a Wisconsin Trust Attorney for More Information

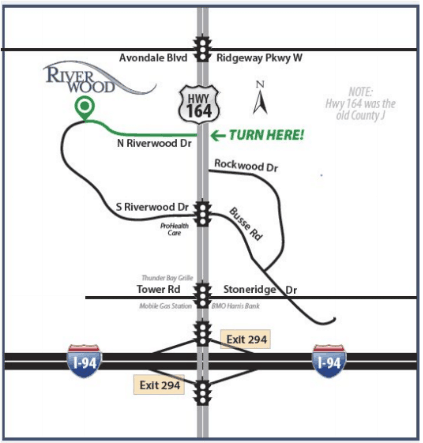

A Wisconsin estate planning attorney can help you devise a strategy utilizing estate planning tools, including trusts, which ensures your wishes and desires will be honored after your death or incapacitation. Contact the estate administration attorneys at Riverwood Legal & Accounting Services, S.C. today for more information about trusts and other estate planning documents.