Most pet owners consider their pets to be members of their family. Surprisingly though, over 500,000 pets are orphaned each year due to the death of their human. This is likely because people are not aware of the options available to ensure that their pets are cared for when they pass. Forty-six states provide provisions for pet trusts, and Wisconsin is proudly one of those states.

Pet trusts are an important part of an estate plan. Estate plans are designed to provide for the care and maintenance of loved ones, so why should pets be left out? While you may think that family members will take care of your furry companion when you die, circumstances may keep them from providing the care that you would want. This is why a pet trust is so critical. It provides you with absolute control over the care of your pet. Before you start typing up your pet trust though, here are some important things to keep in mind.

What is a Pet Trust?

Before we go further, let’s define what exactly a pet trust is. A trust is a separate legal entity that is created for a specific purpose. In this case, the purpose is to provide for the care of your pet when you pass away. You are able to fund the trust with money or other income-producing properties, name a caregiver for your pet as the beneficiary of the trust, assign a trustee to oversee the execution of the trust and manage the trust assets and identify exactly how you want your pet cared for.

Types of Pet Trusts

Depending on the state in which you live, there may be different pet trusts available. This is important to note, in the event that you move after creating your pet trust. Each state has different laws, so if you move, you should always review your estate planning documents and revise if necessary. Types of pet trusts include:

- Statutory pet trusts – allows you to appoint a third party to enforce the terms of the trust on behalf of your pet.

- Honorary trusts – this type of trust allows you the freedom to not assign a specific beneficiary, but instead, determine the purpose of the trust (e.g., provide for the care of your pet). Note, if there is not a state statute specifically authorizing pet trusts, this becomes unenforceable. While not an issue in Wisconsin, if you move, be sure to consult with am estate planning attorney.

- Traditional legal trusts – quite possibly the best way to ensure your pet is cared for. It allows you to place your pet and sufficient assets into the trust to care for the pet. You may designate a caretaker for the pet and a trustee to oversee the caretaker in enforcing the trust.

Benefits of Pet Trusts

Some people think that simply putting instructions for the care of their pet in their will is sufficient. Unfortunately, this is not the case. There is no way to force someone to care for your pet in the way that you want them to. With a pet trust, you can:

- Specify exactly how you want your pet cared for, from nutrition to veterinarians

- Have complete control over the care of your pet

- Revoke the trust or make changes

- Designate a trustee to manage the trust properties

- Identify when the trust becomes active, such as when you become incapacitated

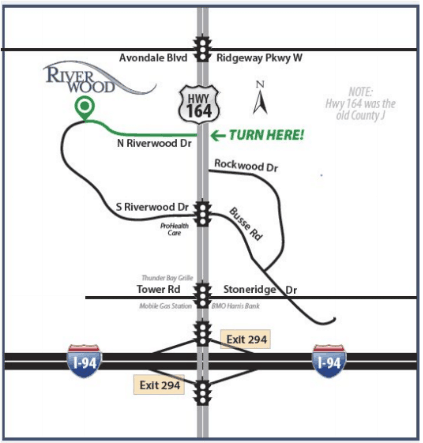

If you have questions about pet trusts and other estate-planning mechanisms, the best thing you can do for your family, your pets, and your own peace of mind is to strategize with an experienced Wisconsin estate-planning attorney. Contact the attorneys at Riverwood Legal & Accounting Services, S.C. today for a consultation.