When you are working on your estate planning with the intention of maximizing what you can give to your beneficiaries and minimizing the amount the government will take away in taxes, you may be looking at several asset protection options. If you have or plan to buy sizeable life insurance policies, you may want to discuss your options with an advanced estate-planning lawyer.

Explanation of an Irrevocable Life Insurance Trust

With an Irrevocable Life Insurance Trust (ILIT), you set up a living trust then transfer the life insurance policies to the trust. You no longer own the insurance, the trust does. The trust will also pay the premiums and distribute the insurance proceeds to your beneficiaries upon your demise. You can never change the trust because it is irrevocable. Being irrevocable protects the trust assets from being taxable. Another requirement to avoid taxes is that you cannot be the trustee.

Downsides of an Irrevocable Life Insurance Trust

You are betting on how long you will live if you transfer an existing life insurance policy into the ILIT. If you die less than three years after transferring an existing life insurance policy into the trust, the insurance proceeds will bounce back into the taxable estate. It may be prudent to replace existing life insurance policies with new policies owned by the trust to avoid this risk.

An ILIT is, by definition, irrevocable. If you change your mind about a beneficiary, for example, you are stuck. Some financial experts suggest the use of partnership or limited liability corporation (LLC) instead of an ILIT so you can retain control yet still avoid taxation.

If you want to make additional contributions to the trust, you might have to pay gift tax. You can address this problem by writing withdrawal rights for the trust beneficiaries, called “Crummey” rights, into the original trust document. Crummey rights make it possible to convert contributions to the trust into a “present interest” asset that can be immediately withdrawn by a beneficiary, up to the current amount of the annual gift tax exclusion.

Beneficiaries rarely, however, make these withdrawals, since the contributions are intended to pay the life insurance premiums. The only purpose of withdrawal rights is to create a loophole to avoid gift tax on contributions to the trust.

An ILIT has an advantage over a partnership or LLC in situations in which you want the trust to hold the insurance proceeds for a while after your death, for example, to allow time for a young child to mature before receiving a substantial amount of wealth. A trust can hold the proceeds according to the terms you chose when creating the trust, but a partnership or LLC must distribute the proceeds when you pass.

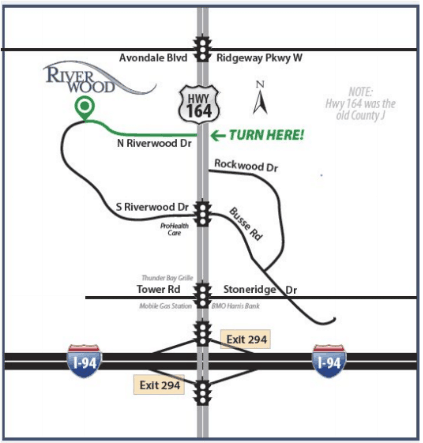

Irrevocable life insurance trusts and partnerships or LLCs that hold life insurance policies are not DIY projects. It is easy to miss a requirement or a restriction and cost your estate and your heirs a fortune in taxes and penalties. Contact the attorneys at Riverwood Legal & Accounting Services, S.C. today for a consultation.