If you have a child with special needs, you have even more things to worry about than a parent of a typical child. You have anxiety over your child’s future. You want to make sure he will have the resources to be comfortable, safe and protected. If you put assets in his name, or if your parents or others leave him money in their wills, he can get kicked out of government benefits programs. In order to ensure that your loved one is protected, you should talk with a probate and estate administration attorney that specializes in special needs estate planning.

The purpose of a special needs trust is to preserve assets for people with special needs without making them ineligible for government benefits. Many government benefits, such as Medicaid and Supplemental Security Income (SSI) have limitations on the amount of assets you can own and be eligible. If you have over $2,000 in assets, you do not qualify for Medicaid or SSI. Medicaid rules carved out an exception for people with disabilities who set up a special needs trust.

Special Needs Trusts

If your assets are in a special needs trust (SNT), they do not count as your assets for purposes of Medicaid or SSI eligibility. Any income generated by those assets also does not count. To pass the scrutiny of Medicaid and SSI, an SNT must meet all these criteria:

- It is an irrevocable trust. In other words, when you put money or other assets into the trust, you will never get them back.

- You can only spend the money for your disabled child, who is the Beneficiary of the SNT.

- The SNT is only allowed to pay certain expenses. If the trust manager spends any of the money on other purposes, the trust fails as an SNT in the eyes of Medicaid and SSI.

- Your child must meet the Social Security Administration (SSA) definition of disabled.

- You cannot pay cash from the SNT directly to your child.

Benefits of Qualifying for SSI

SSI can pay a monthly cash amount to your child, but the most valuable benefit of qualifying for SSI is that, as long as you are entitled to even one dollar of SSI, you are eligible for Medicaid. Since Medicaid provides health care at little or no cost, this benefit is crucial for people with ongoing medical expenses.

How an SNT Can Help Your Child

One example of how an SNT can be useful is if your child is disabled as a result of a catastrophic accident and she eventually receives a substantial personal injury settlement. If that award goes to the child, she will no longer be eligible for government assistance with her medical bills. With an SNT, the proceeds could go into the trust without the child losing her Medicaid eligibility. Otherwise, she would have to spend down the settlement until she reached the $2,000 asset limit, and then go on public assistance with no nest egg for her future care.

Special needs trusts are complicated. They must be set up correctly to satisfy the requirements of Medicaid and the SSA. Since these complex laws can change at any time, you should work with a Wisconsin estate planning lawyer to set up a special needs trust for your disabled child.

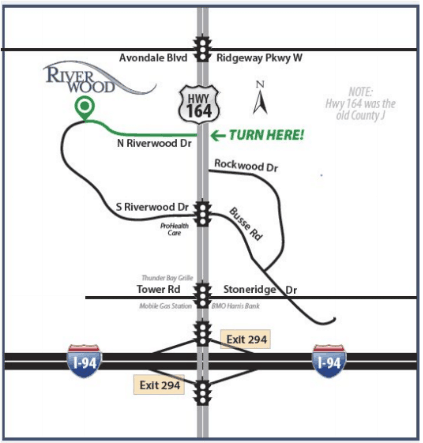

Contact the attorneys at Riverwood Legal & Accounting Services, S.C. today for a consultation.