Asset Protection Strategies

You have worked hard and amassed sizeable assets, but you know that they could all be gone in the blink of an eye. Someone could file a lawsuit against you following a car accident. A visitor or trespasser could become injured on your property. Your business could be targeted for a legal claim. Before this happens to you, it is best to educate yourself and seek the advice of a competent asset protection lawyer. For now, take a look at some asset protection strategies that might help protect your estate from creditors.

Your First Line of Defense

The moat around your castle should be liability insurance. Carry liability insurance for your car and home. Never rely on the minimum coverage. Always carry enough to cover you if things go wrong. Buy optional coverage like personal injury protection (PIP), medical expenses, uninsured driver and underinsured driver, so you do not have to deplete your assets to pay your medical bills and property damage.

Buy umbrella insurance, which can provide from $1 million to $50 million of liability protection. Make sure you have any other applicable liability insurance, like malpractice, business, and professional insurance. Think of every scenario in which someone could sue you, then cover yourself with plenty of liability insurance for that situation, and make sure the insurance also pays your legal defense fees.

Build the Right Structure

A castle with a weak structure will not last long in an attack. Viewing your assets as your castle, have an asset protection lawyer set up the most solid business structure for you. If you own a business or do work on the side in addition to your day job, consider incorporating to shield your assets from creditor claims. Another option is a limited liability corporation to keep lawsuits and creditors from decimating everything you have worked so hard to build.

Depending on your facts, it might be wise to set up multiple corporations or limited liability corporations and spread your assets among these business entities. This approach allows you to put “firewalls” around your various risks, so that even if creditors breach one wall of defense, your other assets are safe.

How to Protect Assets for Your Spouse, Child, or Grandchild

You can set up a spendthrift trust to set assets aside that cannot be reached by any creditors of the beneficiary of the trust. The catch is that these trusts must be for protecting the assets of your beneficiary, and not you. Once you put the assets into the trust, they are no longer yours. If you try to set up a spendthrift trust to protect yourself, it is called a self-settled trust, which is unlikely to protect your assets from creditors. You can, however, try to set up a trust to protect your loved ones.

Educational savings plans can allow you to save for your child’s education while protecting the account from creditors, but the asset protection value of these plans varies by state. In today’s mobile society, the residence state of the account owner and beneficiary will be critical factors.

Another Reason to Save for Retirement

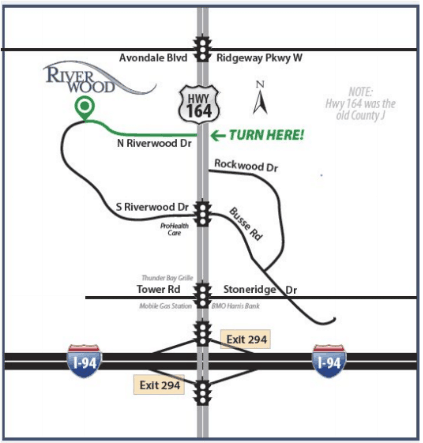

Most qualified retirement accounts, like IRAs and 401(k)s, are protected from claims of creditors. Since multiple bodies of federal law apply to these accounts, you should tread carefully and seek advice from an experienced Wisconsin asset protection lawyer. Contact the attorneys at Riverwood Legal & Accounting Services, S.C. today for a consultation.